As the cost of dental care continues to increase, accepting dental insurance has become an expectation of more and more patients covered by dental plans who choose their providers accordingly.

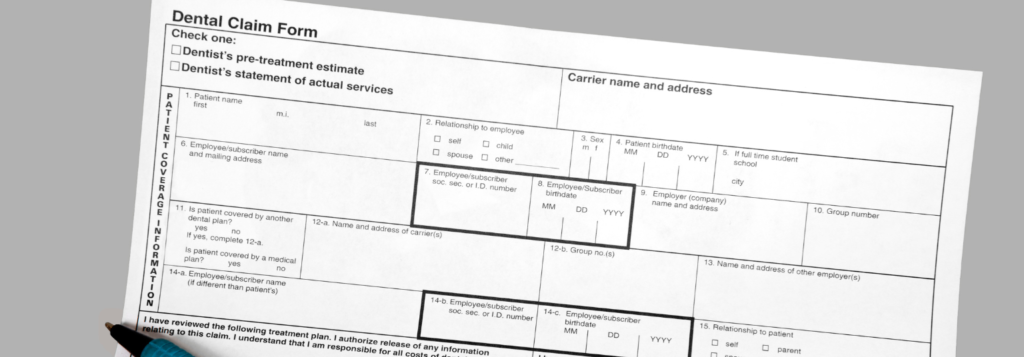

While your dental practice can benefit by having access to a broader patient base, this comes with the additional burden of detailed recordkeeping, accepting pre-negotiated rates, submitting and managing claims & attachments, and then collecting the approved amounts – which can all be quite daunting at times.

As a matter of convenience, some dental practices outsource claim management to third-party AR (accounts receivable) companies; this, however, will cut your profit margins significantly without guaranteeing the ultimate maximization of your collections.

And if you decide to forgo claim management outsourcing, what are the main pitfalls, dangers, and challenges your staff must be aware of — and how can you lower your overall claim management costs, expedite reimbursement, and ultimately improve your practice’s cash flow?

Manual Data Entry: Traditional manual data entry processes are not only time-consuming but also prone to errors.

Mitigations: Use a practice management platform that automates insurance claim processing.

Claim Denials: One of the most frustrating challenges is claim denials (frequently due to ineligibility, the absence of a preauthorization, coding errors, misrepresented coordination of benefits, etc.) and delays (claims on hold waiting for additional information).

Mitigations: Ensure your staff follows best practices and validated checklists when submitting claims manually. A better alternative is to choose a practice management platform that can automate your process with features like:

- Integrated electronic eligibility

- Dental charting with automated coding

- Integrated pre-submission claim validation

- Electronic claim submission with integrated electronic attachments (ideally submitted at the same time as the claim in a single submission step)

- Built-in support for pre-authorizations and coordination-of-benefits claims (primary and secondary)

Coding Errors: Dental procedure codes are complex, often leading to coding errors that result in claim denials or underpayment. One or two surfaces? Per quadrant or per arch? Multiple claimed roots for an incisor?

Mitigations: Consider implementing a practice management platform that has built-in automated CDT coding at the time of charting in addition to when assembling the claim, and confirm that your staff is well-trained in ADA CDT coding procedures.

Forgetting To Submit Claims: Yes, this happens to the best of us – successful dental practices can be helter-skelter environments, and given that you can only submit many claims after the actual services are rendered (not before), submitting these claims can fall through the cracks.

Mitigations: Implement a claim submission reminder system, or choose a practice management platform that triggers automated claim submission tasks for your staff. It is even better if your practice management platform can be programmed to submit insurance claims automatically at a predetermined future date.

Forgetting To Follow Up: Sometimes a claim can be accepted, but blocked while processing or put on hold later on without any ensuing notification to the practice.

Mitigations: Use a separate reminder system, or choose a practice management platform that allows you to view and manage your submitted claims queue.

Missing or Mismatched Attachments: Each insurance company has its own rules for required attachments, even for the same CDT codes. If you forget to include required attachments, like for example x-rays, intraoral or extraoral photographs, periodontal charts, cephalometric analyses, and pre-authorization approvals, your claim could be denied. If you use a separate electronic attachment service, insurance companies could receive attachments late, not at all, or mismatched with your original claim – and your claim will be denied on top of it all.

Mitigations: Select a practice management platform with integrated electronic claim submission and built-in claim validation that automatically notifies you if your claim requires attachment(s) based on the insurance coverage you selected, and supports electronic attachments submitted with the claim in a single submission step. Better yet, choose a practice management platform with integrated imaging and an electronic document vault where patient x-rays, images, periodontal charts, cephalometric analyses, pre-authorization approvals, and more can be linked into claims before electronic submission as a one-step claim and attachments.

Forgetting To Check Coverage Balances: Nothing can be more frustrating than submitting a claim only to have it rejected for exhaustion of benefits.

Mitigations: Choose a practice management platform with integrated electronic eligibility and benefits that can also track the patient’s remaining coverage balance (year-to-date for dental benefits, and lifetime-to-date for orthodontic benefits). Alternatively, have your staff call the insurance company before submitting any claim to verify if any benefits are remaining under that plan (year-to-date or lifetime-to-date, whatever the case might be)

Misclassifying Claims: Orthodontic claims must be classified as such, and misclassifying these will result in immediate claim denial.

Mitigations: Use a practice management platform with automatic classification of claims based on the type of case selected (orthodontic or dental). You might also want to confirm that your staff follows validated checklists and best practices when submitting claims manually.

Wrong NPI: Claims can be submitted either from the Practice’s NPI or the Provider’s NPI. If the insurance company’s registration does not match the claim information, it will get rejected automatically.

Mitigations: Ensure that your staff follows validated checklists and best practices when submitting claims manually. Better yet, choose a practice management platform that allows you to automatically submit claims either from the Practice’s NPI (organization) or from the Provider’s NPI (person).

Navigating the complexities of insurance billing in your dental practice can be daunting, but if you choose to invest in the right tools and/or hire staff with the right education and experience who also follow best practices and use validated checklists, you can prevent most of the pitfalls above and get reimbursed more promptly and with less effort from your staff.